Purpose

This Policy forms part of Housing Australia Fraud and Corruption Control Framework and should be read in conjunction with Housing Australia Fraud and Corruption Control Plan (which together comprise the Framework).

The Framework is established to document and manage Housing Australia’s obligations under the Commonwealth Fraud and Corruption Rule (The Rule). This is a legislative instrument for all entities under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) from 1 July 2024. It sets out the minimum standards for accountable authorities of PGPA Act entities for managing the risk and incidents of Fraud and Corruption relating to their entity. The Rule requires accountable authorities to take all reasonable measures to prevent, detect and respond to Fraud

and Corruption relating to the entity as per (Section 10 of the Public Governance, Performance and Accountability (PGPA) Rule 2014).

In addition, the Framework adopts the elements of the Commonwealth Fraud and Corruption Policy. This policy is for all Non-Corporate Commonwealth Entities (NCEs) from 1 July 2024 however Corporate Commonwealth Entities (CCEs) and Commonwealth Companies are encouraged to adopt the Fraud and Corruption Policy as best practice. Housing Australia is adopting the Commonwealth Fraud and Corruption Policy.

The Framework establishes the key elements required for effective Fraud and Corruption control. These are:

- governance and oversight

- rigorous risk assessments

- informed and targeted control plans

- effective controls encompassing appropriate prevention, detection, investigation, referral and reporting mechanisms

This Policy applies to all Housing Australia Staff. This Policy sets out:

- the objectives of the Fraud and Corruption Control Policy.

- the Fraud and Corruption risks that Housing Australia faces.

- Housing Australia’s approach to Fraud and Corruption; and elements that make up Housing

Australia’s control strategy.

Unless otherwise defined in this Policy, commonly used terms and phrases are defined as:

| Benefit | is not restricted to a material benefit, and may be tangible or intangible, including information. A third party may also obtain a benefit. |

| Corruption | is a dishonest, fraudulent, or even criminal act. It involves using entrusted authority or power to make a personal gain or other unethical or illegal benefits. |

| Corrupt Conduct | There are four types of corrupt conduct under the National Anti-Corruption Commission (NACC) Act 2022. A person engages in corrupt conduct if:

|

| External Fraud | is where Fraud comes from outside the entity from external parties such as clients, service providers, other members of the public or organised criminal groups. |

| Internal Fraud | is where Fraud against an entity is committed by its officials or contractors. Fraud by an official is likely to represent significant non-compliance with the finance law as the official would have breached the general duty of an official under section 26 of the PGPA Act to act honestly, in good faith and for a proper purpose in perpetrating the Fraud. |

| Staff | means persons employed by or operating under an employment or similar contract with Housing Australia including full time or part time employees, consultants, contractors, and officials/directors of Housing Australia and full or part time secondees to Housing Australia. |

Fraud requires intent. It requires more than carelessness, accident, or error. When intent cannot be shown, an incident may be non-compliance rather than Fraud.

Key elements of the Fraud and Corruption Control Policy include:

- Appropriate governance and oversight structures that are proportionate to the operating environment of Housing Australia and are integrated within the Risk Management Framework.

- Fraud and Corruption risk assessments which identifies and documents exposure to Fraud and Corruption, the associated risks, and control arrangements.

- Fraud and Corruption control plans which document, manage, and monitor the current or planned activities to manage Fraud and Corruption risks.

- Periodic review of the effectiveness of controls to ensure controls are working to mitigate the identified Fraud and Corruption risks.

- Prevention is strategies for minimising the risk of Fraud and Corruption and its harmful consequences to Housing Australia, including significant financial and reputational harm.

- Detection of Fraud and Corruption mechanisms including reporting channels.

- Responses to Fraud or Corruption incidents including administrative, civil, and criminal interventions, including containment, disruption, investigation, referrals to the Australian Federal Police or National Anti-Corruption Commission (or the Inspector General of Intelligence and Security for intelligence agencies), disciplinary action, recovery, remediation and where appropriate, prosecution.

- Recording and reporting incidents of Fraud or Corruption, or suspected Fraud, or Corruption via Housing Australia information management systems, and the subsequent response and outcomes.

This Fraud and Corruption Control Policy is owned by Chief Risk Officer (CRO) and reviewed and approved by the Board on a biennial basis or as required if there is a change in the size, scale, and complexity of Housing Australia operations. The Policy is supported by a Fraud and Corruption Control Plan (Plan) which is reviewed annually, and performance of the Plan reported to Board Audit and Risk Committee (ARC). This Plan includes measures to (1) prevent Fraud and Corruption, (2) detect and report Fraud and Corruption, (3) investigate reports of Fraud and/or

Corruption, (4) protect those that disclose Fraud and/or Corruption and (5) discipline those that

commit Fraud and/or Corruption.

Housing Australia has no appetite for not having appropriate policies, plans, and controls in relation to identifying fraudulent conduct or conduct which could be considered as corrupt behaviour on the part of its Staff, recipients of loans, investments, grants, or other assistance from Housing Australia or any other third parties that it deals with. Housing Australia understands that instances of Fraud or Corruption may occur (and has Limited Appetite for this) but that there are effective policies, plans, and controls in place to identify and manage these incidents.

Training on Fraud and Corruption will be held at induction for new Staff and every 2 years for existing Staff to heighten Fraud and Corruption awareness and help create a ‘control consciousness’ within Housing Australia. The Risk Team are responsible for overseeing and co-ordinating appropriate Fraud and Corruption awareness training.

Training is provided to Staff that as a minimum does the following:

- explains what Fraud and Corruption is.

- makes them aware that Fraud and Corruption does occur.

- explains how Fraud and Corruption could occur.

- explains what Staff should do about suspected Fraud and Corruption.

- identifies what their roles are in relation to the prevention and detection and escalation (including mechanisms for doing so) of Fraud and Corruption; and

- describes mechanisms Housing Australia has in place to deal with Fraud and Corruption.

Housing Australia undertakes Fraud and Corruption Risk Assessments at least biennially or when there is a change in its structure, functions, or activities. Risk Assessments are undertaken at Housing Australia Corporate (Enterprise) level and Program level as required.

6.1 CORPORATE

Corporate (Enterprise-level) Fraud and Corruption Risk Assessments consider, and are used to monitor and manage, risks from the perspective of all of Housing Australia. Some of these risks are set out below but further described in the Plan.

6.1.1 Assets

The risk Staff participate in theft, damage or misuse of facilities, equipment, or other physical

assets.

6.1.2 Corporate Information

The risk Staff participate in theft, disclosure or misuse of corporate information, intellectual property,

or other official information.

6.1.3 Human Resources

The risk of fraudulent or corrupt recruitment or contracting practices or decisions (including depriving a person of an employment opportunity if they were the most qualified candidate)

6.1.4 Corporate Funds

The risk Staff participate in theft, misdirect or misuse of payroll entitlements, credit cards, travel or invoice claims or staff benefits (including leave).

6.1.5 Conflict of Interest

The risk of Staff using Housing Australia information to further a personal business interest.

6.1.6 Bribery

The risk of Staff offering, giving, receiving, or soliciting an item of value to influence their actions and to incline them to act contrary to their duty and the known rules of honesty and integrity.

6.2 PROGRAM(S)

Targeted Fraud and Corruption Risk Assessments consider, and are used to monitor and manage, risks that may impact Housing Australia’s specific activities, functions, or programs – these will be conducted for new or significant changes to existing programs. Some of these risks are set out below but further described in the Plan.

6.2.1 Program / Program Procurement Payments

The risk of theft, misdirection, misuse or fraudulent claims of payments and services.

6.2.2 Program Information

The risk of theft, misuse, or disclosure of official program information.

6.2.3 Program Outcome

The risk of misuse of power or position to unethically influence decisions, policy, or outcomes.

6.2.4 False Information

The risk of information provided by third parties to Housing Australia being false and exaggerated by an applicant for a loan, investment, grant, guarantee or other assistance from Housing Australia to induce Housing Australia to approve the loan, investment, grant, guarantee or other assistance application.

6.3 SHARED RISK

Section 15 of the PGPA Act requires Accountable Authorities to consider the effect of decisions on public resources generally, not only those for which the accountable authority is responsible. Targeted Fraud and Corruption Risk Assessments will include collaboration with other involved entities where there are new or significant changes to existing programs to establish a clear definition of the shared risk and the arrangements for managing this risk.

To meet obligations under the Commonwealth Fraud and Corruption Rule, Housing Australia has a documented Fraud and Corruption Control Plan (Plan). The Plan addresses Fraud and Corruption risks identified through risk assessments and is updated after conducting a Fraud and Corruption risk assessment or a re-assessment (per Section 6).

The Plan includes:

- existing preventative, detective and corrective controls linked to identified risks.

- new controls to be implemented with implementation timeframes,

- control owners who are required to monitor and report on the implementation, testing, and effectiveness of controls.

- Control testing program by Three Lines of Defense (3LOD) for the year.

As the Plan includes information that is valuable to those who might try to subvert the entity’s controls to mitigate the risk of misuse, Housing Australia’s Plan is only provided to Control Owners, Control Testers, the Risk Team, and ARC. Other Committees or Staff requesting copies will be provided on a need-to-know basis subject to approval by the Plan Owner.

Housing Australia will periodically undertake review of controls to determine if controls are designed and operating effectively in mitigating the entity’s identified Fraud and Corruption risks. The control testing plan across 3LOD will be determined and documented annually in the Plan. This provides assurance to ARC and Board that the entity’s efforts to prevent, detect and respond to Fraud and Corruption are adequate and effective.

9.1 OVERVIEW

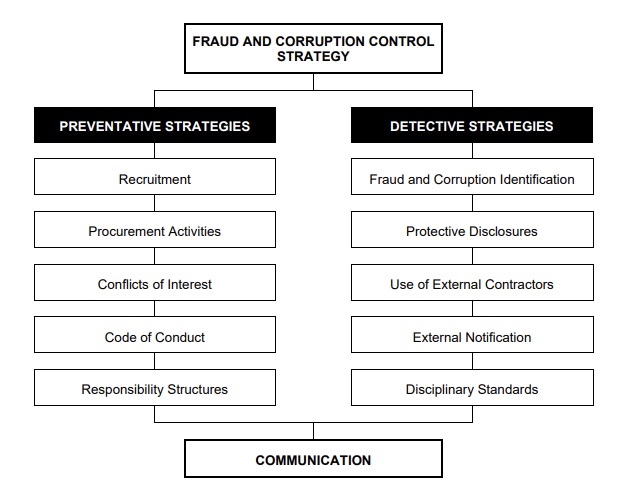

Housing Australia will manage its Fraud and Corruption risk exposure by using a combination of preventive and detective strategies.

Preventive strategies are actions planned and implemented which are designed to counter the risk of Fraud and Corruption and prevent it occurring. Preventive measures are “signposts” which clearly signal to those who may contemplate Fraud and Corruption that it is not acceptable. They also ensure that there are mechanisms in place to detect Fraud and Corruption and act as a deterrent effect.

Detective strategies principally relate to a program which identifies, investigates, and penalises those who choose to ignore the preventive measures and commit Fraud and Corruption. Detective strategies in themselves form a key component of an overall Fraud and Corruption prevention strategy. As preventive measures are concerned with informing Staff of their obligations and warning them against Fraud and Corruption, detective strategies focus on having processes and penalties in place to detect and discipline those who choose to ignore the signposts.

The diagram below depicts the major components of Housing Australia’s Fraud and Corruption control strategy.

9.2 PREVENTIVE STRATEGIES

Housing Australia has implemented Fraud and Corruption prevention strategies to help manage its Fraud and Corruption risk exposure. Housing Australia’s controls are outlined in the Housing Australia’s Fraud and Corruption Control Plan.

9.2.1 Recruitment

In addition to interviews and reference checks, due diligence checks are vital in helping Housing Australia to make informed decisions about Staff recruitment. As part of this Housing Australia undertakes comprehensive background checks.

9.2.2 Code of Conduct

Housing Australia has established a Code of Conduct which outlines the obligations and responsibilities of Staff in relation to their employment or engagement with Housing Australia. The Code of Conduct states that in performing their official duties, Staff are required to be impartial and not pursue personal interests which may conflict with Housing Australia’s interests.

Housing Australia’s Code of Conduct requires all Staff to make a written declaration of their private interests which may, or may be perceived, to conflict with Housing Australia’s interests. If a Staff member is unsure as to whether a conflict exists, the situation should be declared regardless. Staff have a responsibility to be aware of all aspects of the Code of Conduct to ensure they perform their duties in an appropriate manner.

9.2.3 Conflict of Interest Policy

Housing Australia’s Conflicts of Interest Policy sets out Housing Australia’s approach to the effective identification and management of conflicts of interest that affect it and its Staff. Housing Australia’s Conflict of Interest Policy provides guidance to Staff on the mechanisms for reporting and managing conflicts of interest.

9.2.4 Procurement Activities

Housing Australia’s Procurement Framework aims to reduce risks and promote transparency, integrity, assurance and accountability throughout procurement planning, evaluation, contract execution and in the delivery of contracted goods and services. The Procurement Risk Assessment contains checks to assist making informed decisions about whether vendors, supplier companies or service providers are suitable to deliver goods or services for or on behalf of the Housing Australia and include questions and checks to indicate “red flags” for Fraud and Corruption.

Contractors and the staff of contracted service providers (including subcontractors) are regarded as staff of an entity under the NACC Act 2022. This means that the National Anti-Corruption Commission (NACC’s) authority extends to investigating potential serious or systemic corrupt conduct of service providers. Refer to Section 10.2 for obligations in this regard.

9.2.5 Responsibility Structures

Staff are required to submit an annual declaration of compliance which confirms they have complied with Housing Australia’s policies and procedures, and undertaken training relevant to their role, including the requisite Fraud and Corruption awareness training.

All Staff are subject to ongoing monitoring and oversight in their roles, according to Housing Australia’s responsibility structures and reporting lines.

9.3 DETECTIVE STRATEGIES

Housing Australia has implemented Fraud and Corruption detective strategies to help manage its Fraud and Corruption risk exposure. Housing Australia’s controls are outlined in the Housing Australia’s Fraud and Corruption Control Plan.

9.3.1 Fraud and Corruption Identification

All Staff are obliged to report alleged or suspected cases of Fraud and Corruption to Housing Australia as soon as they are detected in accordance with this policy, Housing Australia’s Public Interest Disclosure Policy and/or Housing Australia’s Incident Reporting Policy. The CRO will be informed about all incidents of Fraud and Corruption. All Staff are to co-operate fully in the investigation process.

9.3.2 Protected Disclosures

Housing Australia is committed to supporting those who report Fraud and Corruption in good faith. To the extent possible, and subject to requirements under the Public Interest Disclosure Act 2013 (as applicable), informants will be kept anonymous during the investigation process, where this has been requested, and, where possible, informed of the outcome of the investigation, including any reasons for not furthering the investigations. If a disclosure leads to disciplinary proceedings, the informant’s identity will only be revealed as is required by legislation, the Australian Federal Police, or the relevant court.

Housing Australia will not allow informants to be victimised. Where possible, any such behaviour will result in disciplinary action against those involved.

9.3.3 External Contractors and External Notification

Housing Australia’s external contractors and other third parties can notify Housing Australia of potential Fraud and Corruption through Housing Australia’s public website.

Responding to Fraud and Corruption can involve a range of administrative, civil, and criminal interventions, including containment; disruption; investigation; referral to the Australian Federal Police (AFP), NACC or Inspector-General of Intelligence and Security (IGIS); disciplinary action; recovery; remediation, and where appropriate prosecution.

Except for matters that are accepted for investigation by the AFP or the NACC, Housing Australia will investigate or respond to suspected instances of Fraud and Corruption. Where the AFP or NACC declines a referral, Housing Australia will resolve the matter as documented in the Plan. A decision to outsource any investigation will be made by CEO in conjunction with CRO.

Every reported incident of suspected Fraud or corrupt conduct will be taken seriously. In some cases, there will prima facie be grounds for concern, in other cases – where there is a lack of evidence and/or the facts are not easily established it will be necessary to undertake preliminary fact-finding. This work will be overseen by the CRO, or someone nominated to oversee the work on their behalf. They will determine what fact-finding work is required and whether a qualified fraud investigator needs to be involved at this stage. In doing so, they will consult closely with the CEO, and if appropriate Chief Legal Officer (CLO) and Internal Audit.

At the end of the fact-finding, the following outcomes are possible:

a) there are no grounds for concern and no further action is required.

b) while there is no evidence of a specific Fraud or corrupt conduct having taking place, work is needed to make processes more secure and/or tighten internal control systems.

c) while there are concerns about conduct, the matter is not covered by the Fraud and Corruption framework and should be dealt with under other applicable Housing Australia policies (e.g. Code of Conduct).

d) there is evidence of Fraud (or attempted Fraud), or Corruption and the case is referred back to CRO and CEO and if appropriate CLO.

The Plan details Housing Australia approach to criteria and management of a suspected Fraud or Corruption incident including decisions to investigate, refer the matter to another entity, apply civil or administrative remedies, or to take no further action in response to a suspected Fraud or Corruption incident.

10.1 FRAUD INVESTIGATIONS

All cases involving credible evidence of suspected Fraud are subject to the Commonwealth Fraud and Corruption Control Framework, to be reported to the AFP. Should Fraud be detected, or allegations be made, Housing Australia will initiate a preliminary assessment of the matter as soon as is practicable to determine whether there is any evidence to substantiate the allegation. If it is determined that a fraud investigation is required, Housing Australia will consult with the AFP to determine the appropriate course of action and may utilise the services of an appropriately qualified external provider and ensure that any investigation is conducted in accordance with the Australian Government Investigation Standards (whereapplicable).

Where appropriate and as required, the CEO will consult with other entities where a potential Fraud incident impacts on the responsibilities of the other entity, in accordance with any legislative obligations or powers dealing with information sharing.

10.2 CORRUPTION INVESTIGATIONS

If Housing Australia becomes aware of a Corruption issue, then the CEO must refer the issue to the NACC if:

- The Corruption issue concerns the conduct of a person who is, or was, a staff member of the agency while that person is, or was, a staff member, and

- The CEO suspects the issue could involve serious or systemic corrupt conduct.

A Corruption issue refers to a whether a person:

- has engaged in corrupt conduct in the past,

- is currently engaging in corrupt conduct, or

- will engage in corrupt conduct in the future.

The CEO must refer the Corruption issue as soon as practicable after they become aware of it. This may include disclosures made under the Public Interest Disclosure Act 2013. The referral must explain why the Corruption issue could involve conduct that is serious or systemic and provide the NACC with all the information and documents in their possession or control that relate to the Corruption issue.

Where appropriate and as required the CEO will consult with other entities where a potential Corruption incident impacts on the responsibilities of the other entity, in accordance with any legislative obligations or powers dealing with information sharing.

10.3 RECOVERY ACTIONS

Where an Australian resident, citizen or corporation, or its agent, has been or engages in bribery in relation to an application for a loan, investment, grant, or other assistance made by Housing Australia, Housing Australia may:

- if the loan, investment, grant, guarantee, or other assistance is yet to be approved, refuse to approve the loan, investment, grant, or other assistance; and

- if the loan, investment, grant, guarantee or other assistance has been approved, refuse to

provide, or cancel the loan, investment, grant, guarantee or other assistance or accelerate repayments.

Housing Australia would endeavour to recover proceeds of Fraudulent activity.

10.4 INVESTIGATION OUTCOMES

10.4.1 Fraud and Control Plan

Where the investigation identifies weaknesses in Risk Assessment or controls then this will be reflected in an update to Fraud and Corruption Control Plan as soon as practicable.

10.4.2 Disciplinary Standards

Any Staff against whom clear evidence of Fraud and Corruption has been obtained, should be expected to be:

- dismissed without compensation; and

- reported to the AFP or NACC.

Fraud and Corruption Incidents are recorded in the Housing Australia Incident Register and reported to Executive Risk & Compliance Committee (ERCC) and the Board Audit and Risk Committee (ARC) on a quarterly basis.

The Australian Institute of Criminology (AIC) will publish an annual report on Fraud and Corruption relating to Commonwealth entities by 31 July each year. To facilitate the AIC annual report Housing Australia must provide information for the previous financial year in the form requested by the AIC.